Merlin

You chose a custom title

Yesterday was a pain in the arse.

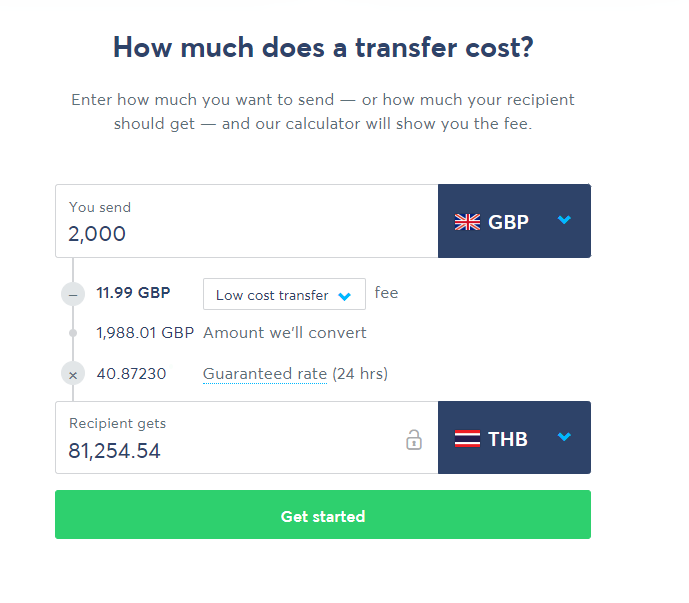

My wife and step-daughter were leaving last night to enrol jnr. at Chulalongkorn University today. I wanted some extra cash for them and decided to use an HSBC Debit Card at my branch of Bangkok Bank in Robinsons. I rarely use the ATM machine due to the 220THB charge (plus the overseas transaction charge, plus the lousy exchange rate.) After going through the palaver of handing over my card, my pink I.D. card, and my UK Passport for copying and countersigning - the passport being a new requirement to allow the transaction to be authorised - WTF - I entered my pin number incorrectly. I tried again, making sure the number was typed correctly. Nope - refused. They said the card was declined by my bank. Really?

I drove home and phoned HSBC (the battery on my mobile was at 1%) The spotty oik at the other end thought he was talking to a 5 year old. He said that there was nothing wrong with my card. His system showed that one incorrect number had been attempted, and confirmed that we have THREE attempts to get it right. My card had not been locked, blocked, or otherwise manipulated by HSBC and that there were adequate funds in the account. He said I should go back to Robinsons branch of BKK Bank. Step daughter said "use the one in Big C or elsewhere in Surin." Having tried that before, without any joy, I reluctantly decided to use an ATM as time was running out. Then, I remembered that I'd wanted to put some cash in my Bkk Bank account anyway, so went to Big C. The teller there apologised and said that they don't have a debit card machine at the counter (just the external ATM) Apparently, Bkk Bank only allow two branches in Surin with the appropriate device. I used the ATM instead. Back into the branch to deposit the cash... It took an hour and a half to complete the process from start to finish.

This, or similar, has happened on a few occasions, and, when the branch is queuing to the door and I can't be bothered waiting an hour for my turn, I use the ATM outside. If it is a weekend near the end of the month, and the machine might be running low on cash, the damn thing gives priority to Thai bank cards, and refuses to deliver cash to us mortals.

I relate this because of the tendency, worldwide now, for banks to prefer electronic transactions over cash, claiming that printing/minting/processing cash is expensive, as is maintaining/filling/repairing ATM machines. So we are to be encouraged, in future, to use our smartphones to pay for everything.

Has no-one told these bankers that Thai shops/restaurants/service stations rarely accept anything else except cash? And the same applies in some other countries too as I read here: https://www.cnbc.com/advertorial/20...hilippines.html?__source=taboola|globe|msn-uk

So many people are unable to open banking facilities in the Philippines (only 23% of adults have accounts!) that putting an electronic system in place disenfranchises a whole bunch of most businesses' customers! The march towards a cashless society, (engineered that way by the banks in the banks' interests and NOT their customers') is unlikely to be stopped, but relying on an electronic facility as I once did (but only once) late one Sunday night in Bangkok to fill the car with sufficient fuel to drive back to Surin only to find that the Thai ATM system wasn't playing ball (according to HSBC who said that there was no record on their system of any ATM card activity on my account that day) demonstrates the perils of attempting electronic transactions.

What's the solution - apart from carrying far too much money for comfort in my wallet or at home?

My wife and step-daughter were leaving last night to enrol jnr. at Chulalongkorn University today. I wanted some extra cash for them and decided to use an HSBC Debit Card at my branch of Bangkok Bank in Robinsons. I rarely use the ATM machine due to the 220THB charge (plus the overseas transaction charge, plus the lousy exchange rate.) After going through the palaver of handing over my card, my pink I.D. card, and my UK Passport for copying and countersigning - the passport being a new requirement to allow the transaction to be authorised - WTF - I entered my pin number incorrectly. I tried again, making sure the number was typed correctly. Nope - refused. They said the card was declined by my bank. Really?

I drove home and phoned HSBC (the battery on my mobile was at 1%) The spotty oik at the other end thought he was talking to a 5 year old. He said that there was nothing wrong with my card. His system showed that one incorrect number had been attempted, and confirmed that we have THREE attempts to get it right. My card had not been locked, blocked, or otherwise manipulated by HSBC and that there were adequate funds in the account. He said I should go back to Robinsons branch of BKK Bank. Step daughter said "use the one in Big C or elsewhere in Surin." Having tried that before, without any joy, I reluctantly decided to use an ATM as time was running out. Then, I remembered that I'd wanted to put some cash in my Bkk Bank account anyway, so went to Big C. The teller there apologised and said that they don't have a debit card machine at the counter (just the external ATM) Apparently, Bkk Bank only allow two branches in Surin with the appropriate device. I used the ATM instead. Back into the branch to deposit the cash... It took an hour and a half to complete the process from start to finish.

This, or similar, has happened on a few occasions, and, when the branch is queuing to the door and I can't be bothered waiting an hour for my turn, I use the ATM outside. If it is a weekend near the end of the month, and the machine might be running low on cash, the damn thing gives priority to Thai bank cards, and refuses to deliver cash to us mortals.

I relate this because of the tendency, worldwide now, for banks to prefer electronic transactions over cash, claiming that printing/minting/processing cash is expensive, as is maintaining/filling/repairing ATM machines. So we are to be encouraged, in future, to use our smartphones to pay for everything.

Has no-one told these bankers that Thai shops/restaurants/service stations rarely accept anything else except cash? And the same applies in some other countries too as I read here: https://www.cnbc.com/advertorial/20...hilippines.html?__source=taboola|globe|msn-uk

So many people are unable to open banking facilities in the Philippines (only 23% of adults have accounts!) that putting an electronic system in place disenfranchises a whole bunch of most businesses' customers! The march towards a cashless society, (engineered that way by the banks in the banks' interests and NOT their customers') is unlikely to be stopped, but relying on an electronic facility as I once did (but only once) late one Sunday night in Bangkok to fill the car with sufficient fuel to drive back to Surin only to find that the Thai ATM system wasn't playing ball (according to HSBC who said that there was no record on their system of any ATM card activity on my account that day) demonstrates the perils of attempting electronic transactions.

What's the solution - apart from carrying far too much money for comfort in my wallet or at home?