Yorky

Fullritis Member

Copied from another thread:

Yorky: In contrast we went to Kasikorn Bank in Robinson's today at 10:50 and left around 13:20 having closed one fixed deposit account and opened another.

Coffee:

Curious Yorky though off-topic:

1) what was the percentage rate on the new account ?

2) what is the length (fixed term) on the new account ?

3) is the account FCA as £ or a THB account ?

1) what was the percentage rate on the new account ?

Interest at 1.30% p.a.

2) what is the length (fixed term) on the new account ?

12 months (0.90% for 3 months, 1.15% for 6 months)

3) is the account FCA as £ or a THB account ?

THB account.

Yorky: For information, for 24 months the interest rate is 1.45% p.a. and for 36 months the interest rate is 1.60% p.a.

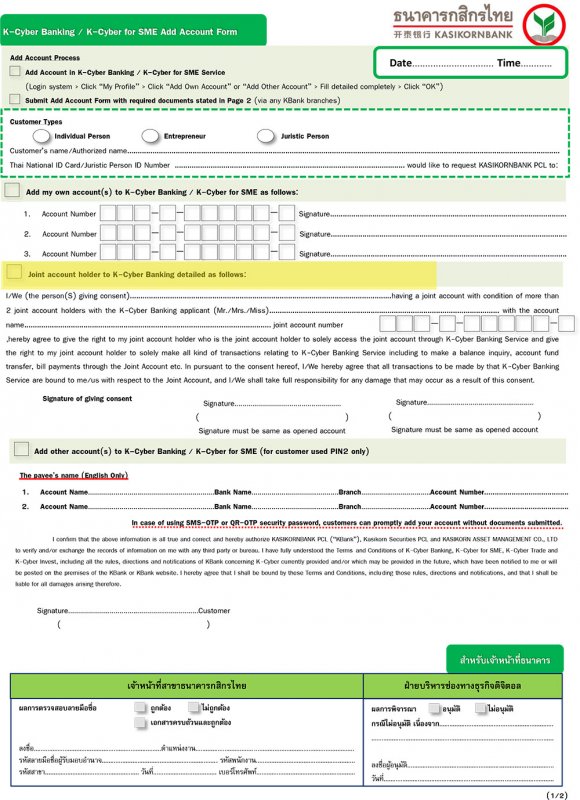

For further information, the bank employee was unsure whether we would have access to view the status of the account online (I'm aware that Kasikorn do not have facilities for any transactions to be effected in respect of fixed deposit accounts). Head Office will advise me later apparently.

Yorky: In contrast we went to Kasikorn Bank in Robinson's today at 10:50 and left around 13:20 having closed one fixed deposit account and opened another.

Coffee:

Curious Yorky though off-topic:

1) what was the percentage rate on the new account ?

2) what is the length (fixed term) on the new account ?

3) is the account FCA as £ or a THB account ?

1) what was the percentage rate on the new account ?

Interest at 1.30% p.a.

2) what is the length (fixed term) on the new account ?

12 months (0.90% for 3 months, 1.15% for 6 months)

3) is the account FCA as £ or a THB account ?

THB account.

Yorky: For information, for 24 months the interest rate is 1.45% p.a. and for 36 months the interest rate is 1.60% p.a.

For further information, the bank employee was unsure whether we would have access to view the status of the account online (I'm aware that Kasikorn do not have facilities for any transactions to be effected in respect of fixed deposit accounts). Head Office will advise me later apparently.