You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Land Tax

- Thread starter Yorky

- Start date

Bandersnatch

Surin Solar Legend

I own a condo in BKK and a few minutes ago I received a letter from a government body in Huai Khwang where my condo is located. It includes details of my condo and a similar picture to the one Yorky posted above. There is no information about if I have to pay tax or how much might be due.

I was surprised that they were able to find me in Surin as I bought the condo over 15 years ago and only registered my new address here a couple of months ago.

I was surprised that they were able to find me in Surin as I bought the condo over 15 years ago and only registered my new address here a couple of months ago.

Yorky

Fullritis Member

We owned a rice farm near Lamduan (12 rai) for which the land tax was ฿ 52.00 p.a. We had to drive around 40 km to pay it! I asked our neighbours when we moved in to the house (both government officials) about land tax for the house. He said "Unless they ask for it, we don't pay it and we haven't done to date".

Prakhonchai Nick

You chose a custom title

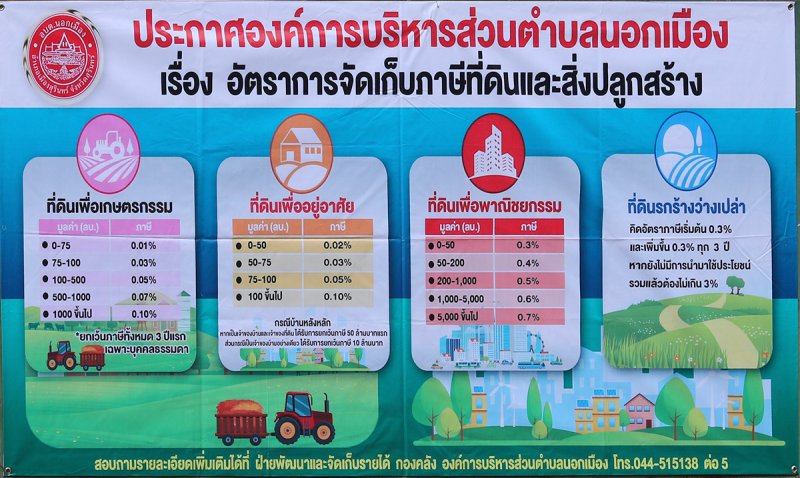

The amount of tax payable clearly relates to size of the land, house or whatever from the above picture, but none of my uneducated neighbours that have been asked can tell me what the numbers in the left hand column relate to. Is it tarang wah, square metres, rai.........Nobody knows!

Yorky

Fullritis Member

The amount of tax payable clearly relates to size of the land, house or whatever from the above picture, but none of my uneducated neighbours that have been asked can tell me what the numbers in the left hand column relate to. Is it tarang wah, square metres, rai.........Nobody knows!

According to my (barely educated) wife the numbers in the left hand column denote how much the total land is worth in millions of baht. Otherwise to what would the percentages in the right column relate?

Last edited:

Prakhonchai Nick

You chose a custom title

I had not considered value. If that is the case, who I wonder determines value? As usual in Thailand no doubt a sweetener would produce a favourable value

Yorky

Fullritis Member

I had not considered value. If that is the case, who I wonder determines value? As usual in Thailand no doubt a sweetener would produce a favourable value

Well, it will definitely not be the owner who determines the value. I don't know whether it will be the value of purely the land or the land and any buildings. My land is said to be worth Bht 3,000,000.00 so given the above scale, the tax would be 0.02% or Bht 600.00, not of sufficient concern to offer any sweetener to reduce it.

CO-CO

Rather wrinkly & occasionally cantankerous member

My missus had a meeting at the Orbitor's office about this and had to give dimensions of the house and outbuildings.

Mrs Yorky is correct; the text under under the image of the house says that you will not pay tax if you have a 'house only' worth 10m or less - or if 'house and land' worth 50m or less.

Looks like a wealth tax and I doubt it will apply to many SF members.

Mrs Yorky is correct; the text under under the image of the house says that you will not pay tax if you have a 'house only' worth 10m or less - or if 'house and land' worth 50m or less.

Looks like a wealth tax and I doubt it will apply to many SF members.

CO-CO

Rather wrinkly & occasionally cantankerous member

Well, it will definitely not be the owner who determines the value. I don't know whether it will be the value of purely the land or the land and any buildings. My land is said to be worth Bht 3,000,000.00 so given the above scale, the tax would be 0.02% or Bht 600.00, not of sufficient concern to offer any sweetener to reduce it.

See post #8 and get your barely educated spouse to opine on the statement I refer to.

Yorky

Fullritis Member

See post #8 and get your barely educated spouse to opine on the statement I refer to.

Together with her reading glasses and a magnifying glass she has concurred with the 10/50 million exceptions (she could have gone outside and read the erected sign). I'd be very surprised if the tax applies to anyone in our village unless there's a large landowner in the background.

Bandersnatch

Surin Solar Legend

The Land and Property tax bill for my condo in Bangkok has arrived. The condo is worth about ฿4million but they seemed to have valued it at the price I paid for it 15 years ago which is half that. The tax due for this year is ฿42 There was a number of QR Codes and bar codes on the bill, one of which brought up my account and exact bill on my SCB mobile app, but would not let me pay it.

My girlfriend said that you could only pay from Krungthai Bank, which sounded a bit odd to me. Eventually I gave up and drove to Robinson and waited 25 minutes in the queue (11am Monday - but still crazy busy) to be able to pay at the counter. I was charged an extra ฿10 for the privilege. I asked the girl why I could not pay with my SCB app "Mai Dai" (Cannot)

My girlfriend said that you could only pay from Krungthai Bank, which sounded a bit odd to me. Eventually I gave up and drove to Robinson and waited 25 minutes in the queue (11am Monday - but still crazy busy) to be able to pay at the counter. I was charged an extra ฿10 for the privilege. I asked the girl why I could not pay with my SCB app "Mai Dai" (Cannot)

Coffee

You chose a custom title

Well that's a nice surprise for your birthday ! @Bandersnatch

Prakhonchai Nick

You chose a custom title

For ฿42, was it really worth it? It must cost them more than that to collect it.

Same applies to the motorbike tax at 100baht - was 100baht 34 years ago, and probably long before that. One would have thought the government wouldn't have missed out on the extra money.

Yorky

Fullritis Member

For ฿42, was it really worth it? It must cost them more than that to collect it.

The tax on 12 rai of rice paddy was ฿52.00 20 years ago. It cost me more in diesel to go and pay it.

Yorky

Fullritis Member

I asked the girl why I could not pay with my SCB app "Mai Dai" (Cannot)

Well, they rarely admit to "mai roo".

Bandersnatch

Surin Solar Legend

Yesterday they made an announcement on the village tannoy to come to the moobaan meeting room to pay house tax. Went today and was told you only have to pay tax if you have a business like a shop on your land or you don’t have a nor sor sam (Chanote)

If you have just a house or farm with chanote it is free.

Anybody else hear this?

If you have just a house or farm with chanote it is free.

Anybody else hear this?

nomad97

Resident Geek

I think your understanding is correct. My wife has never paid tax on her house in Surin.Yesterday they made an announcement on the village tannoy to come to the moobaan meeting room to pay house tax. Went today and was told you only have to pay tax if you have a business like a shop on your land or you don’t have a nor sor sam (Chanote)

If you have just a house or farm with chanote it is free.

Anybody else hear this?

Yorky

Fullritis Member

Yesterday they made an announcement on the village tannoy to come to the moobaan meeting room to pay house tax. Went today and was told you only have to pay tax if you have a business like a shop on your land or you don’t have a nor sor sam (Chanote)

If you have just a house or farm with chanote it is free.

Anybody else hear this?

We were told many years ago (by a village notice (#1)) that land tax was going to be levied in the village. The notice has since been renewed (I didn't notice when) but we've heard nothing more.