Pattaya Mail article:-

Most expats in Thailand live on income or capital, or both, built up over many years with tax already paid in the country of passport. They are understandably worried by the imminent change in Thai Revenue practice – it is not a new law passed by parliament – which will potentially tax new and...

www.pattayamail.com

Myths about Thai expats and those income tax changes starting very soon

Most expats in Thailand live on income or capital, or both, built up over many years with tax already paid in the country of passport. They are understandably worried by the imminent change in Thai Revenue practice – it is not a new law passed by parliament – which will potentially tax new and assessable foreign-sourced income beginning in January 2024.

Pattaya Mail has received more concerned reader feedback about this issue than any other during 2023. With inauguration day fast approaching, here is our summary for the typical expat who does not indulge in major currency speculation, huge profit-taking from overseas businesses nor off-shore bank accounts hiding their cash.

Has the Thai Revenue clarified the position of typical expats? No. It is commonly assumed that the Revenue is mainly interested in rich Thais and foreigners who have manipulated Thai tax rules in the past to avoid payments from overseas. Typical expats with home-country pensions or social security allowances are not part of this agenda, though in theory they could be caught in the crossfire. Talks are continuing between senior accountancy firms, lobby groups and the Revenue about this and other issues. Don’t expect answers any time soon.

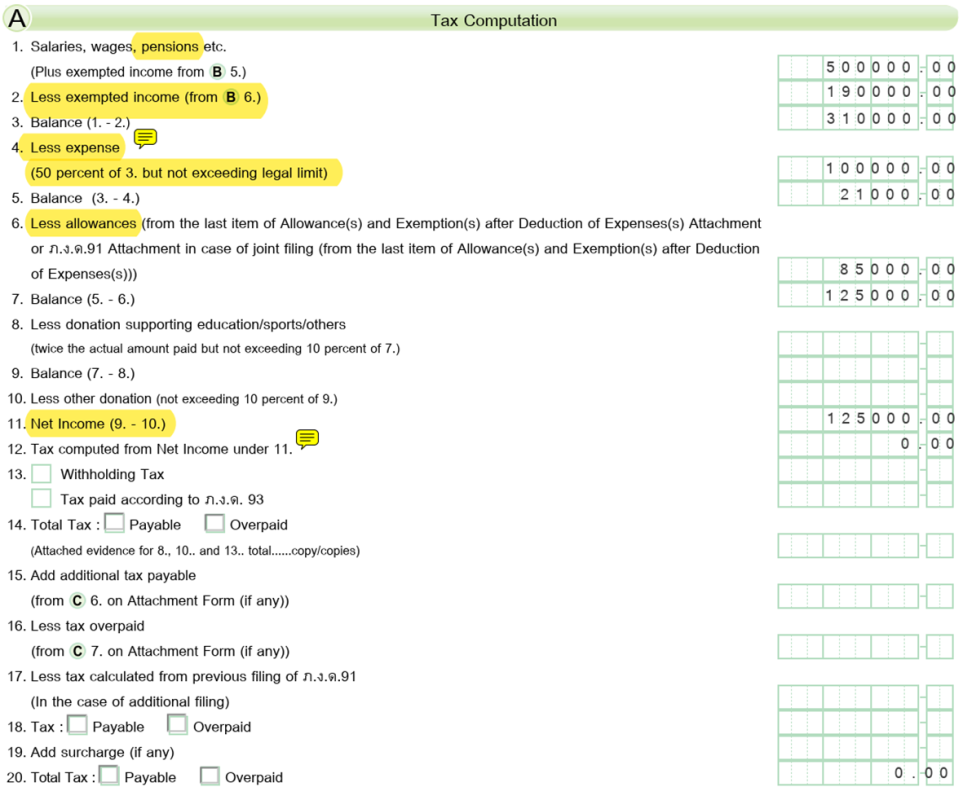

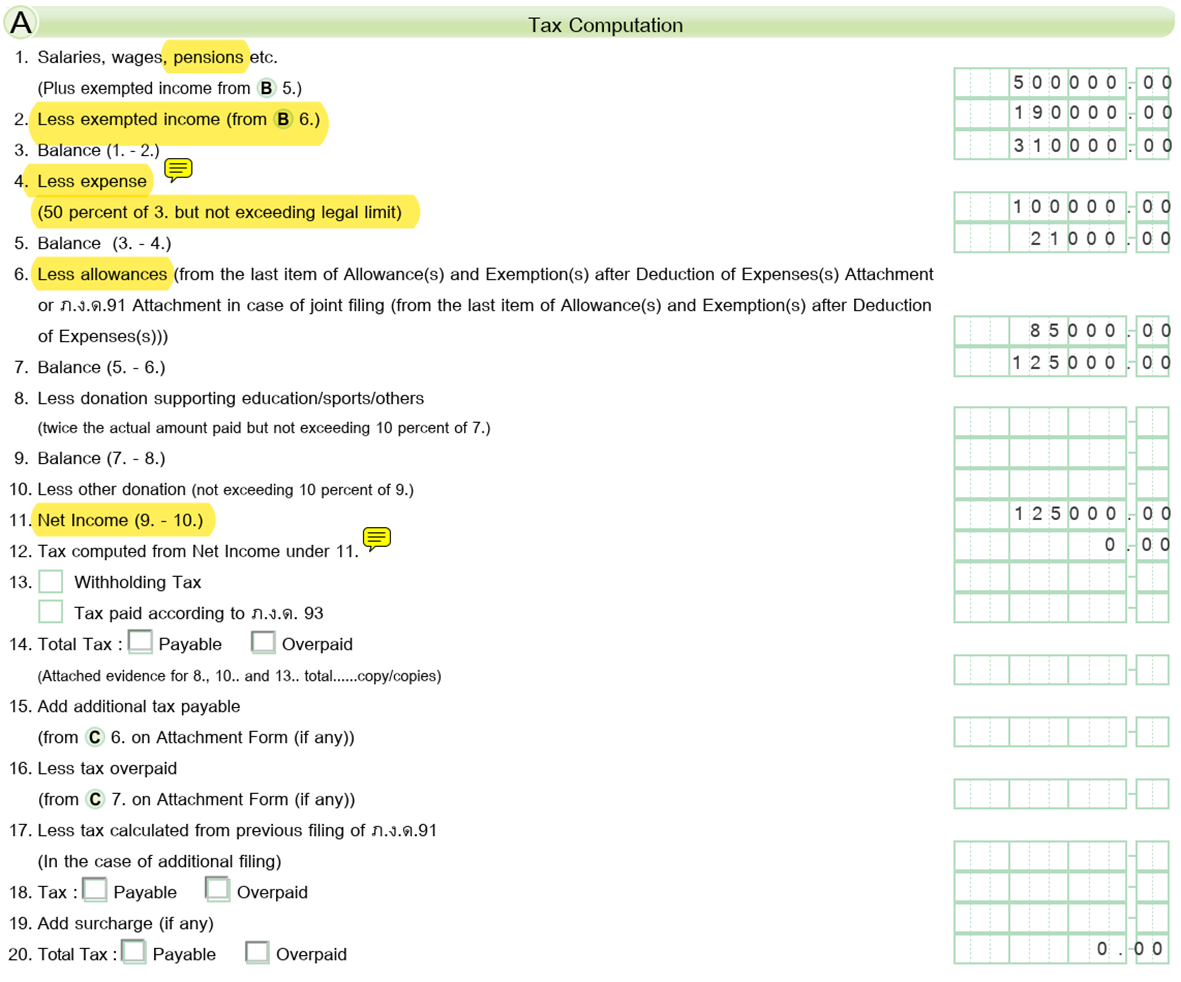

Will my international cash transfers to Thailand from January 1 2024 be reduced on arrival by a Bank of Thailand tax levy? No. There will not be any changes from current practice. You pay tax in arrears in Thailand by registering at the Revenue for a tax identification number and paying tax due, if any, in the next fiscal year. There is no PAYE procedure in Thailand. The misunderstanding that Thailand will tax international transfers as the cash arrives is a widespread misconception

Should I apply for a tax identification number? Not unless you receive an instruction from a government source or the immigration, both very unlikely scenarios. It is almost certain that, at any rate in the early years, tax registration will be voluntary. If you believe you have been taxed already on your cash sent to Thailand, it’s best to do nothing now. There is no need to employ the services of tax accountants if you are a typical expat (unless working here on a work permit which is a separate subject). The tax situation as regards cash sent to Thailand to purchase property is a separate source of ambiguity.

Most countries with expats here have a double taxation treaty with Thailand, so is that relevant? That depends on the exact wording of complex documents which differ substantially one from another. Double taxation treaties are designed to be used only in cases where Thailand and the first country cannot agree on who has the right to tax. If Thai Revenue were to clarify unambiguously that previously taxed income would not be retaxed, the issue would largely die.

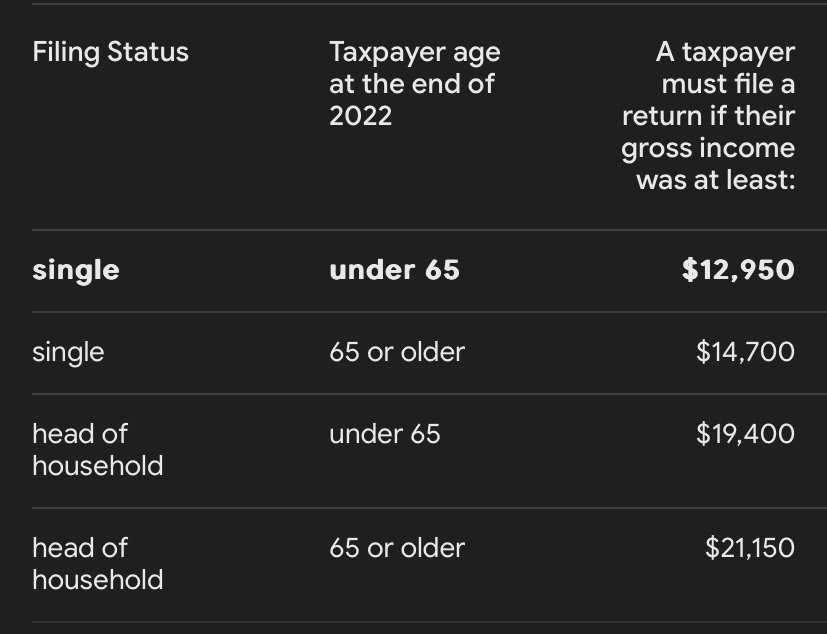

If I need to later, how will I prove that my cash transfers to Thailand have already been taxed? This will vary on an individual basis. An expat’s tax return or the response by the internal revenue service of the first country might suffice, or a simple statement on a tax form might be acceptable. Few experts, if any, believe that the Thai Revenue has the staffing or the expertise to deal with more than 300,000 expats who are tax residents because they spend more than 180 days here in a fiscal year. It bears repeating that the registration process will likely be voluntary. The Thai government is looking for the big fish, Thai or foreign, and not the small fry.

How does Thai Revenue know about your international cash transfers? Most countries in the world, around 120 and including Thailand, are now part of the CRS (Common Reporting System) which requires financial institutions worldwide to fight tax evasion and to protect the integrity of tax systems by sharing your banking transactions with partner countries. This means that your international transfers have been/ are/ will be monitored by Thai financial authorities. Some experts believe that Thai Revenue will use CRS as the route to question rich Thais and foreigners about large international transactions. Amongst the countries not registered for CRS are North Korea and the Vatican.

What is the Thai government really up to? The new post-coup government simply wants to raise cash, in part to help pay for its populist policies such as the 10,000 baht give away scheme. One can assume that nobody in authority has yet thought seriously about the effects of the change on the expat market here and the potential unpopularity amongst long-term visa holders including one year retirement extensions, Elite and the 10 year Long Term Residence. If you are an expat living in Thailand for at least half the year, without any major financial secrets to keep from Thai Revenue, then it’s best to do nothing until the situation is clearer. That’ll take several months yet. But no point in packing your bags in disgust and leaving for Cambodia. They are a CRS country too