CO-CO

Rather wrinkly & occasionally cantankerous member

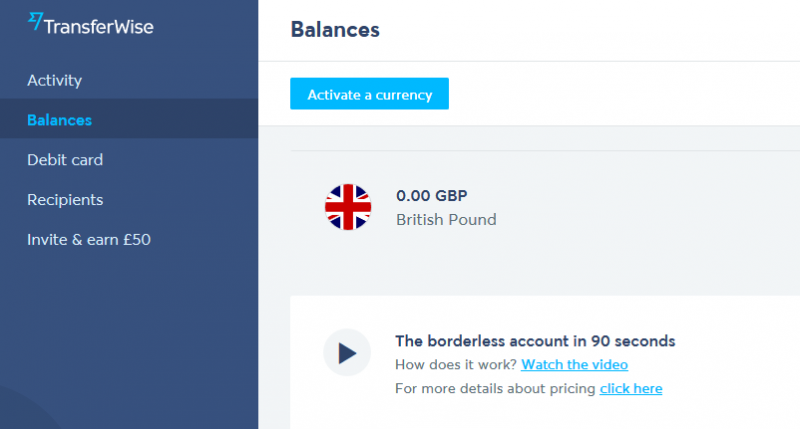

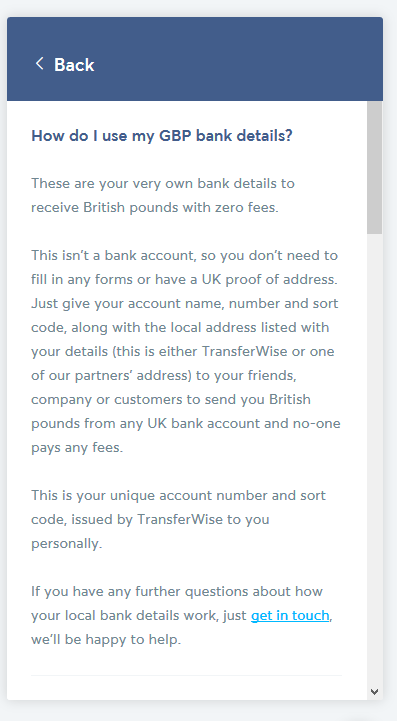

There are now 2 possible options for expats (i.e. UK non-residents) to have a UK bank account.

The latter is a mobile only service and the Monzo application is downloaded.

https://transferwise.com/gb/borderless/

https://monzo.com/

The latter is a mobile only service and the Monzo application is downloaded.

https://transferwise.com/gb/borderless/

https://monzo.com/